As warnings about a potential bubble in the Artificial Intelligence (AI) market escalate, Nvidia CEO Jensen Huang has offered decisive statements refuting this perception, asserting that the current phenomenon is not a bubble but a profound technological transformation driven by real and growing demand for computing power.

Huang’s comments came during his participation in the US-Saudi Investment Forum, held at the Kennedy Center in Washington D.C. on November 19, 2025. He stated:

“From our point of view, we don’t see a bubble. What we see is a fundamental change in the way software is being built, and this requires an entirely new infrastructure.”

Three Arguments Against the Bubble Idea

Huang presented three main points to justify his rejection of the bubble concept:

- Shift in GPU Utilization: The shift in the use of Graphics Processing Units (GPUs) into profitable commercial areas, such as advertising recommendation systems and data processing, reflects a genuine expansion in demand, not just a temporary surge.

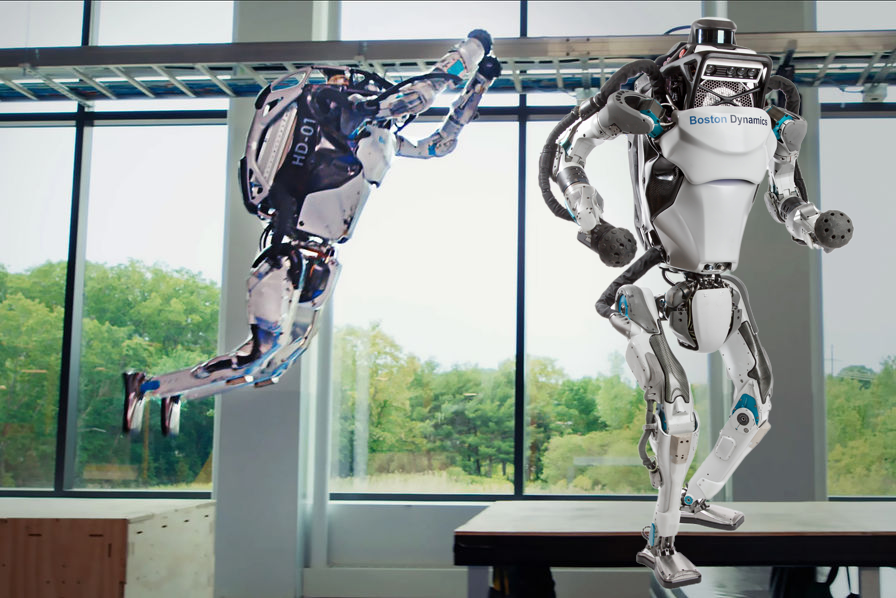

- Creation of New Business Models: AI is not merely accelerating existing applications; it is creating entirely new business models, such as robotics and physical AI, leading to the emergence of new companies and unprecedented products.

- Explosive Computational Demand: Intelligent systems that interact with the user with minimal input will require massive computational power. This strengthens the demand for advanced Nvidia chips like Blackwell and justifies the sustained market growth.

Between Nvidia and Google: A Difference in Angle, Not Substance

Google’s CEO had previously warned of a potential AI bubble, noting that its explosion would affect all companies, including Google itself. The essence of the bubble is that the valuations of AI companies might be exaggerated, similar to what happened during the dot-com bubble at the turn of the millennium.

In that era, most technology companies possessed actual value, but excessive expectations regarding their growth rate led to inflated market prices. When those expectations were not realized as quickly as anticipated, the bubble burst. Nevertheless, many of those companies, such as Microsoft, later recovered their value, but it took more than a decade.

Does Huang Truly Address the Bubble Issue?

In reality, Huang does not address the bubble from an economic or valuation perspective; rather, he focuses on the side of technological demand and infrastructure. He speaks about the genuine opportunities afforded by AI applications, not about the valuation of companies in the financial markets.

Therefore, I do not disagree with Huang on the technological transformation and the increasing demand for computing. However, this does not negate the existence of a bubble, which manifests as an exaggeration in the valuation of AI companies due to overestimating the speed of returns or the magnitude of the immediate impact. This remains the core of the ongoing discussion surrounding the bubble.